One of the Typical Characteristics of Management Fraud Is:

One of the typical characteristics of management fraud isa. Unpacking the 9 characteristics of fraud perpetrators.

What Is A Fraud Risk Assessment And Why Do I Need One Auditboard

One of the typical characteristics of management fraud is.

. Illegal acts committed by management to evade. Falsification of documents in order to misappropriate funds from an employer. Victimization of investors through the use of materially misleading financial statements.

Characteristics of Victim Organizations. Its possible to make adjustments in subledgers but this requires collusion with other organizational departments which is much harder to accomplish. EXECUTIVE SUMMARY The top-side journal entry is most susceptible to fraud by management override.

Illegal acts committed by. Victimization of investors through the use of materially misleading financial statements. Conversion of stolen inventory to cash deposited in a falsified bank account describes an employee fraud.

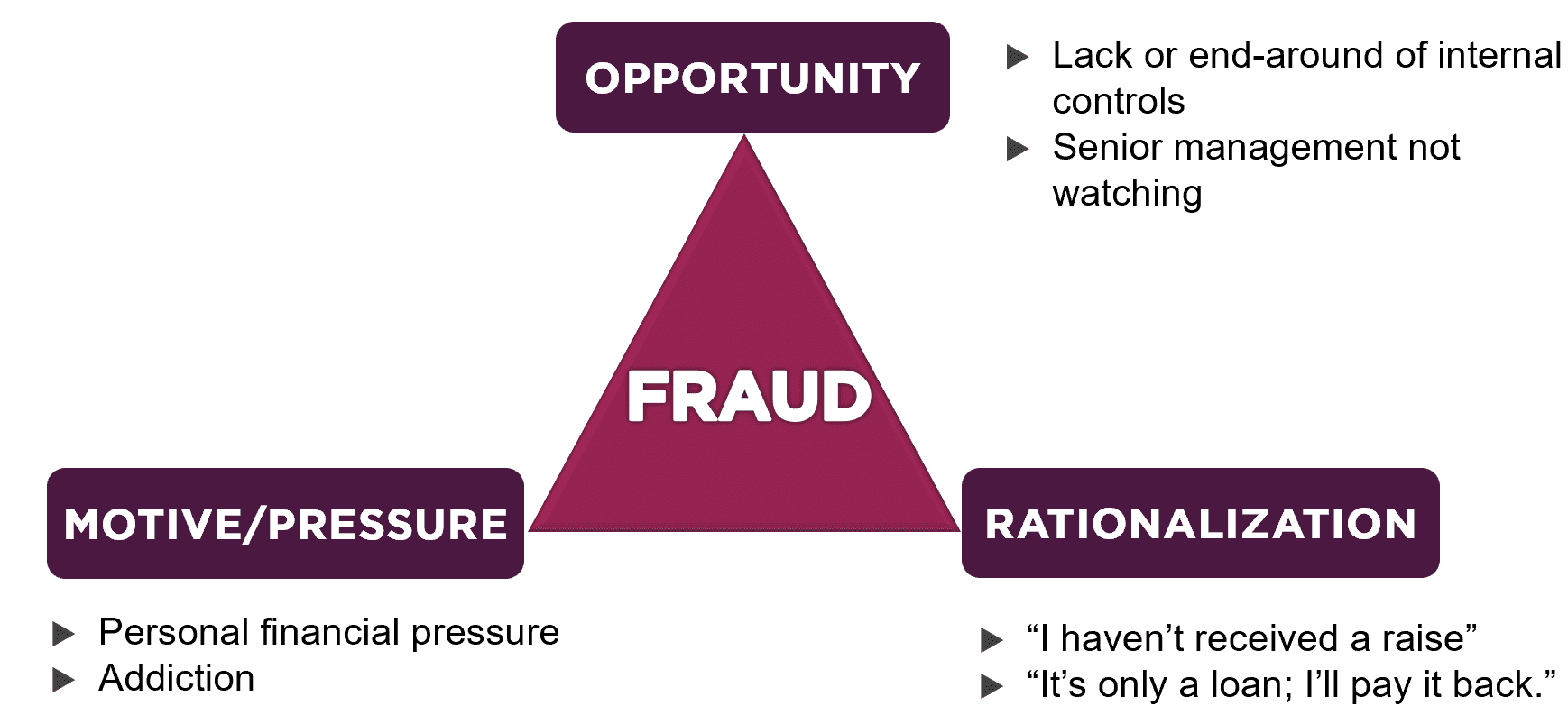

Common characteristics accompany most fraud- for-profit schemes and identifying them can be helpful in determining whether a loan is part of a larger fraud scheme. 1 Opportunity 2 Incentive and 3 Rationalization. Multiple Choice Illegal acts committed by management to evade laws and regulations.

Why is the typical profile of a fraudster so unremarkable. Falsification of documents in order to misappropriate funds from an employerb. And Capability as different characteristics and warning.

One of the typical characteristics of management fraud isa. One of the typical characteristics of management fraud is. In the instance of corporate fraud there is a sole victim the organization and usually there are multiple occurrences of theft that impact that organization.

Where silence may itself amount to fraud and. Consumer fraud occurs when a person suffers from a financial loss involving the use of deceptive unfair or false business practices. Although its less common financial statement fraud can be the most damaging to a company.

Its one of the most common types of employee fraud according to the ACFE it occurs in 27 per cent of businesses and lasts for an average of 36 months. Falsification of documents in order to misappropriate funds from an employer. One of the typical characteristics of management fraud is a.

Falsification of documents in order. It generally takes more than one year to detect a fraud. The following are the top 10 essential elements of fraud.

Victimization of investors through the use of materially misleading financial statements. While eighty-five percent of fraudsters displayed at least one of the following behaviors fifty percent exhibited multiple red flags. In addition the study found that organizations with hotlines detected fraud sooner six months sooner on average and suffered lower losses than organizations without hotlines.

Falsification of documents in order to misappropriate funds from an employerb. Overstating revenue earnings and assets along with understating liabilities or just plain concealing them are the most common activities found with this type of fraud. Illegal acts committed by management to evade laws and regulationsd.

Victimization of investors through the use of materially misleading financial statementsc. To constitute fraud there must be some representation or assertion which is untrue. Solutions for Chapter 3 Problem 35MCQ.

Typical profile of a fraudster. The most frequent types of management fraud involve fictitious or premature revenue recognition. If any misappropriation of assets occurs it is usually well hidden.

Misappropriate funds from an employer. Can come from any area of expertise independent of sector. The fraud triangle is a framework used to explain the reason behind an individuals decision to commit fraud.

Explain the characteristics of management fraud. Fraud refers to the deception that is intentional and caused by an employee or organization for personal gain. One of the typical characteristics of management fraud is.

Has been working for the company for more than five years. Management fraud typically occurs at levels above where the internal control system is effective. According to the last ten surveys conducted by the Association of Certified Fraud Examiners the tip six red flag behaviors have not changed.

Accounts ReceivableIn fictitious credit sales and fictitious receivables. The FBI characterizes fraud as comprising of deceit concealment and or violation of trust. Interestingly 43 of all fraud is detected by a tip mostly coming from employees with a typical fraud case lasting 14 months before detection.

For entities that did have a hotline one of the factors that increased its usage was employee fraud awareness training. In the absence of representation or assertion except in the following two cases there can be no fraud. Falsification of documents in order to misappropriate funds from an employer.

Fraud is not usually dependent on the application or threat of physical force or violence. One of the typical characteristics of management fraud is. So its a significant risk especially for small businesses where there are usually fewer controls.

Above-average level of education and creativity. Victimization of investors through the use of materially misleading financial statements. The information being shared is based on the ACFEs biannual Report to the Nations on occupational fraud.

Fannie Mae is committed to working with our industry partners to help combat fraud by providing this list of f raud schemes and their c haracteristics. Illegal acts committed by management to evade laws and regulations. Living beyond their means.

One of the typical characteristics of management fraud is. Falsification of documents in order to use misappropriate funds from an employer. Victimization of investors through the use of materially misleading financial statements.

False and Willful representation or Assertion. Illegal acts committed by management to evade laws and regulations. Criminal energy is not discernible.

The study also suggested a model for fraud management. Victimization of investors through the use of materially misleading financial statements. Falsification of One of the typical characteristics of management fraud is a.

With identity theft thieves steal. Financial statements are frequently modified to make the firm appear more healthy than it actually is. Illegal acts committed by management to evade laws and regulations.

The fraud triangle consists of three components. One of the typical characteristics of management fraud is a. Victimization of investors through the use of materially misleading financial statements.

Victimization of investors through the use of materially misleading financialstatementsc. Unusually close association with vendorcustomer.

Characteristics Of Typical Fraud Perpetrators Business Infographic Workplace Financial Literacy

Fraud Triangle Fraud Opportunity St Louis Cpa Firm

My Book Of Quotes Wise Quotes About Love Affirmation Quotes Fraud Quote

No comments for "One of the Typical Characteristics of Management Fraud Is:"

Post a Comment